Let me preface this post by saying that I am not a certified public accountant, nor am I an accountant. I am simply someone who loves calculations and loves to help people save money. This post is an explanation of how I would determine if my family should refinance a mortgage.

I’ve heard it said that you should only refinance if you can save more than 1/2 a %. I’ve also heard you should only refinance if you can save 1 % or better. Which is right? Not necessarily either one- The amount of interest, your principal balance, and how long you plan to stay in your home are the determining factors. Another important thing to consider is what type of loan you currently have. If you have an ARM (adjustable rate mortgage) then it would be wise to lock in a fixed rate before interest starts to rise. It’s really a mathematical game to see whether refinancing will be a good financial choice for YOUR family with YOUR family’s circumstances. Here’s how I would make the decision:

First- look up your current interest rate and the principal balance of your current loan. Then find out how many years you have left to pay on that loan (years left to pay it off completely) Also think about how many years are left until you plan to move or downsize/upsize.

Then second, call a lender to inquire about refinancing. Be prepared -the seller (yes, their job is to sell you a new mortgage) will exclaim about how much money you’ll be saving over the life of the loan. Find out what interest rates they will offer with no points or less than 0.125 points. (we’ll talk about points next week) Also ask what the closing costs associated with the loan would be. Let them know you need to run your numbers and you’ll call them back if you’re interested. Don’t stay on the phone and let them try to convince you with big numbers! Then call your current lender to see if they can beat what you’ve been offered. Chances are they can offer you the same rate but with fewer closing costs since they already hold the title and have an appraisal on file.

Next, compare the cost of interest for each loan that

you are offered to the cost of your current interest rate over the length of time that you plan to stay in your home. I

recommend using the mortgage calculator at interest.com to make these

calculations. Plug your principal balance, current interest rate and the years left on your loan into this calculator. Now open a new window and plug your principal balance, quoted interest rate, and the years left on your loan into the calculator again. Find the total interest box for the year/month for when you expect to move on the first chart (your existing rate) and subtract the expected closing costs of your refinance. Compare that total to the same year/month on the new rate chart. This amount is how much money the refinance would save you, based on the time you have left in the home. Not nearly as much as the “seller” at your mortgage company told you because they are assuming you’ll stay in the home for another 30 years!

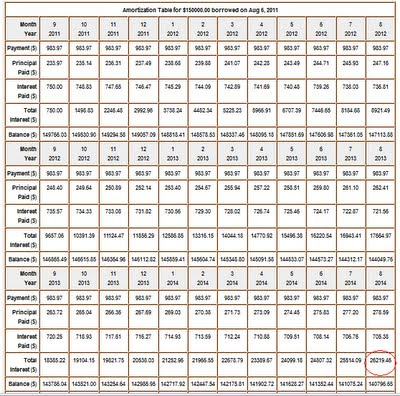

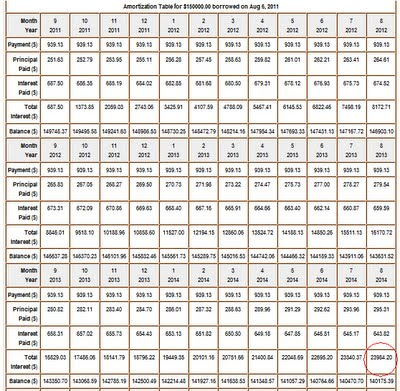

Did I loose ya? Let me walk you through an example with only a 1/2 a % gain. Let’s say that the principal balance on your home is

currently $150,000. You have

24 years left to pay on the loan and don’t expect to make any extra

principal payments for a few years. Here are screen shots of a $150,000

loan with 24 years left to pay at 6% and 5.5%. (use two windows so you can compare the two) What you are paying attention to is the running total of interest paid.

If the closing costs on this refinance would be $3275, it would take 4 years and 5 months to break even from a refinance with the parameters above! If you plan to stay in the home less time than that, you’ve lost money. If you only stay in your home 2 additional years, then your gain at 6 years and 5 months is around $1400 from refinancing. If you stay in your home for the entire 24 years your gain from this refinance would be less than $10,000 after you consider the closing costs.

But wait- there’s something else to consider: The impact your closing cost funds could have to your existing loan if you used them as an extra principal payment instead of refinancing. Using the same calculator, enter the closing cost amount as an extra principal payment the month after your loan start date. Now subtract the new interest total for the same box where you plan to move from the old total for the same box. For our example, your gain after 6 years and 5 months from putting the $3275 as an extra principal payment instead of refinancing would be $1509 – a better choice if you were moving around this time. If you stayed in your home the entire 24 years, your gain would be right at $10,000. (the same as the refinance from 6% to 5.5 %)

If this were my family’s loan, I wouldn’t refinance unless I found a lender that would do it for no closing costs (they do exist). There simply isn’t any gain to be had if the difference is only 1/2 a %. I would use the closings costs as an extra principal payment and have the same results without all the paperwork. If I could gain more than 1/2 a % then I would probably refinance.

I can run calculations with a smaller loan and a shorter length loan,

reducing the interest by a full % and have similar results. I can also run figures on larger loans with longer lengths at 1/2 a % gain with better results. This is why there is no cut and dry answer for “should we refinance” without running the figures based on your current mortgage, amount you can afford to pay each month and the time you have left in your home. Play with the available rates based on your circumstances, to make the best decision for your family.

Next Thursday I’ll explain what points are and show you why they usually aren’t a good thing to pay on your mortgage. Points are easier to explain, but felt I should cover refinancing first

Thanks for this. We refinanced last year and it was a good thing for us. Mainly because the interest rates were much better than what we had when we originally bought our house. We went from a 30 to a 15 year with very little variation in the payment. Plus, I like the idea of paying off the house sooner rather than later.